Examples of Economic Growth Challenges

Your economic challenge can be at a city, regional, or country level. Here are some examples of economic growth challenges that past participants have worked on during the program.

High rates of unemployment or underemployment

Increasing inequality, with many not being included in the growth process

High rates of poverty and low growth

Volatile growth dependent on one source

Disruption of major economic activities due to the pandemic, e.g. tourism

Lack of fiscal space to save jobs and address pandemic

Macroeconomic instability and recurrent balance of payments shocks

Low productivity due to poor human capital development

Skills mismatch between skills you have and the jobs you want to create

Lack of quality jobs; high levels of informality in the economy

The Top 10 U.S. Economic Issues to Monitor - A Peer-Reviewed Academic Articles

Exit polls from the 2008 New Hampshire primary confirmed that 97 percent of Democrats and 80 percent of Republicans are worried about where the economy is headed. [1]

Forecasting economics is one of the more dangerous endeavors of life. The reason is actually quite simple: “History is economics in action,” as Karl Marx noted.

Marx, who got almost everything else wrong but most likely got this right, connected economics to everyday reality.

In their famous book The Lessons of History, Will and Ariel Durant explain that economics in action is the contest among individuals, groups, classes, and states for food, fuel, materials, and economic power.[2] Economics is a very dynamic system that changes quickly due to the shifting causes and directions of individuals, and is therefore a very difficult system to forecast.

Most individuals are unaware of the economics underway that could seriously erode their retirement plans and could very well cause them to modify their investment choices.

This article will not forecast, but rather will address what many believe to be “The Top 10 U.S. Economic Issues to Monitor.” They were chosen by the author, and are not listed in order of importance.

Number One: Government Expenditures and Deficits

In The Lessons of History, the Durants wrote:

The experience of the past leaves little doubt that every economic system must sooner or later rely upon some form of the profit motive to stir individuals and groups to productivity.[3]

Hence, the U.S. form of capitalism should be embraced. Indeed, virtually all corporate retirement investment choices assume this notion as a given. A commitment to capitalism suggests a major commitment of resources to individuals and limits on the power and resources of government. One of the most disturbing economic trends is the ever increasing percentage of government expenditure in the U.S. Gross Domestic Product (GDP).

GDP is the sum of consumption (C), investment (I), and government (G) expenditures in a closed (no goods in or out) economy. That is, GDP=C+I+G. In the United States, the government is taking an increasing share of resources and this has trended sharply upward since 1947. Federal defense spending is running at a rate of about 5 percent of GDP; federal non-defense spending is at 7 percent; and state and local government is approximately 12 percent-a total of 24 percent of the U.S. GDP. This number does not include transfer payments like Social Security.

If the trend continues, the amount of government expenditure could have a very negative impact on the nation’s ability to consume goods and build plants and equipment for future economic growth. Former U.S. Federal Reserve Chairman Alan Greenspan gave a clear warning of this threat when he stated before Congress, “Unless we do something to ameliorate it [federal budget deficits] in a very significant manner, we will be in a state of stagnation.”[4]

In addition, the size of federal government debt has increased from $2.13 trillion in 1986 to $9 trillion today.[5] In 2006, the federal government reported a deficit of 1.8 percent, a statistic that did not take into account the surplus money spent from Social Security. The actual deficit number used by the Comptroller General David Walker is -3.3 percent.[6] Even he says the stated government number is wrong! This number is simply unacceptable and unsustainable, especially in light of the forthcoming Social Security and Medicare funding problems. The key question is: “As a society, are we deriving value for all of our taxes?”

Number Two: Social Security

There is no such thing as a Social Security[7] savings account. Social Security takes in enough taxes today to remain viable until 2017 (depending on who you speak with and on what day). Unfortunately, these funds are not in a piggy-bank. They are invested in special government securities (IOUs). The borrower (the U.S. federal government), according to both former Secretary of the Treasury Paul O’Neil and now Comptroller General David Walker of the Government Accountability Office (GAO), is in serious financial difficulty that needs to be addressed immediately. Walker has said it is necessary to balance the budget within the next five years, make a down payment on the $50 trillion imbalance, and begin reforming government programs. “Time,” he said, “is working against us.”[8]

Many believe that there will be little return from Social Security and/or Medicare unless substantial changes are made very soon. These changes might include:

Raising or eliminating the maximum payroll ceiling for Social Security and/or Medicare; Raising the payroll tax rate(s); Raising the retirement age; Adjusting Cost-of-Living Adjustments (COLA) to reflect true inflation; Investing some funds held by Social Security in domestic and foreign bonds and stocks; Taxing social security benefits for very wealthy Americans; Reducing benefits for retirees in the very distant future (perhaps affecting those now in their 20s); and Establishing a proper estate tax.[9]

Currently, the anticipated benefits of Social Security and Medicare to individuals are greater than their contributions. Adding to the complexity of this problem are: the graying of America (the growing aging population of America and the industrial world), and the fact that American workers simply face higher taxes and lower wages. This does not take into account the decline in consumption (other than healthcare) that will result from the ageing American population. The end result is a further decline in the standard of living for the average American.

Number Three: Concentration of Wealth

The Durants also noted: “Since practical ability differs from person to person, the majority of such abilities, in nearly all societies, is gathered in a minority of men. The concentration of wealth is a natural result of the concentration of ability and regularly occurs in history.”[10]

One of the major trends that must be monitored is the increasing concentration of wealth in America. Capitalism and democracy accelerate this problem. This can be seen clearly in the following data, which shows entrepreneurship rewards, as well as-unfortunately-an increased concentration of wealth.

The richest, or top 1 percent of the country, now own 34.3 percent of the nation’s private wealth and 36.9 percent of all corporate stock. These numbers are growing. In 2005, this group received 21.8 percent of all pre-tax income-just 30 years ago, in 1976, they only accounted for 8.9 percent of U.S. income. The total inflation-adjusted net worth of the Forbes 400 rose from $470 billion in 1995 to $1.25 trillion in 2006.[11]

This concentration may reach a point, as the Durants state, “…where there is an unstable equilibrium which results in redistribution of wealth through taxation or redistribution of poverty through revolution.”[12] In the past, the United States has chosen taxation, for example, during the periods of 1933 to 1952 and 1960 to 1965, but it is unclear whether the government will follow this peaceful path yet again.

Number Four: Median Family Income

One of the most illuminating ways to view any economic problem is through the status of the middle class of a population. In general, the middle class has determined the political outcomes of almost every modern nation since the French Revolution. In the minds of many, the middle class will determine America’s fate.

To discuss the middle class, one must establish a standard. Many believe that the middle class standard is best described as an educated group (actually, this would be upper middle) with upward economic mobility, that is: safe homes and workplaces, worthwhile jobs with compensations that advance above inflation and are in line with demonstrated increased productivity, acceptable levels of healthcare, comfortable retirements, and acceptable amounts of debt. This is the standard that America has worked to achieve since World War II. If the number of people within this category begins to decline, many believe that all is lost.

Using median economic data, the middle class is under siege. Statistics show that the median family income (inflation adjusted) sharply increased from 1947 to 1970, due in part to sharp increases in productivity. Since then, however, incomes have been stagnant; 2000 to 2005 actually showed a decline of 0.5 percent in median family incomes.[13] One should also note that these numbers are derived before, not after, taxes.

The expectation that each generation will do better than their parents has become a fundamental part of what we call “The American Dream.” In a recent article the Brookings Institute stated, “New data suggested that this once solid ground may well be shifting. This raises provocative questions about the continuing ability of all Americans to move up the economic ladder and calls into question whether the American economic meritocracy is still alive and well.”[14]

Number Five: The Savings Rate

Already noted is that the median family savings rate has substantially declined. (One should be aware that in our GDP equation, all savings equal, investment by definition).

From 1960 to 1990, the personal savings rate in the United States was 8 to 10 percent. As family incomes have stagnated, this rate has collapsed and in 2006-for the first time since the Great Depression (when many individuals spent their last nickel for food)-the personal savings rate was negative. When the dire outlook for Social Security is taken into account along with this statistic, an alarming picture of the future of the United States is painted.

Given the status of Social Security/Medicare (discussed in Number Eight), if America is going to have long-term viability, the personal savings rate must move upward to a more realistic positive level-not only to provide for retirement, but also to provide capital for long-term investment [In the U.S. GDP equation, savings equal investment (S=I).][15]

Number Six: Consumption Binge

One of the reasons that personal savings are so low is that individuals have gone on a consumption binge, even in the face of stagnate incomes. Normally, market forces would correct this binge in part by increasing the costs of consumable goods. But recent times have been different. There are groups out there (especially one-China) willing to trade consumable goods for America’s seed stocks by financing federal budget deficits through the purchase of federal debt, thus enabling the funding of higher mortgages on consumer’s homes. So, the consumption binge continues. It is, however, moderating as the dollar declines in value and home values decrease.

Number Seven: No Retirement Funds

A recent Wall Street Journal article reported that most baby boomers under 65 have less than $150,000 saved for retirement; those under 50 have saved less than $50,000.[16] Such low savings are clearly not sufficient for a comfortable retirement and may force retirees back into a lifetime of work.

Many times, the funds that are invested in the stock market are invested more as a gamble in an effort to “catch up.” Apparently, the relationship between savings and the time value of money is unclear to most employees. From early debt repayment to life cycle decisions, the burden is on individuals to fend for themselves. A long-term plan with adequate contributions is needed in order to prepare for retirement, particularly in light of the Social Security dilemma.

Number Eight: High Family Debt

The median family has never had so much debt. It has been far too easy to obtain home credit and personal credit, especially through credit cards. Perhaps the best way to describe it is in terms of total liabilities as a percentage of total assets. In 1999, the average (not median) was 19.7 percent per median family. In 2004, that percentage rose to 29.3 percent. Almost everyone believes the percentage is well above that today. These statistics are “mark to the market”-in other words, actual market values of both real estate and stocks are used. (Remember debt is fixed, but asset values are variable.) If we see a decline in values in the housing market and/or the stock market, these total liability percentages will jump dramatically. A solid recession would wreak havoc on these asset categories, in addition to bringing on the threat of unemployment.

Number Nine: Healthcare

Most economists simply do not know what to say about this extremely important and looming issue. There is already pressure on the system, as baby boomers require more healthcare as they age. America also has an increasing immigrant population that has had little or no medical care in the past and is therefore likely to be more expensive to care for in the future. This means that healthcare costs should continue increasing well above the inflation rate.

The only viable solution for most employees is to fund any and all healthcare savings options as rapidly as possible. Assume there is no Medicare. If one receives it, the retirement years will even be that much more pleasurable.

Number Ten: The Current Account Deficit

It has already been mentioned that there are groups willing to lend to us so we can continue our consumption binge. This dilemma adds a new economic concept to our equation. A country can now have imports and exports (NE) into our economy, that is, GDP=C+I+G+NE. It becomes a little more complex when one takes into account the federal government’s borrowing of funds to operate, which also falls into this current account category.

The current account deficit is about 7 percent of our GDP-more than double the previous modern record of 3.4 percent in the middle 1980s. Back then, the value of the U.S. dollar dropped by 50 percent against the other major currencies over a three-year period from 1985 to 1987 as a result. The Euro could go as high as US$2.00 from the approximate US$1.47 of early 2008.

Many, however, including our current Federal Reserve Chairman Ben Bernanke, do not believe that this high current account deficit will be that harmful,[17] largely because of the capital account (see explanation below).[18] In economic reality, the capital account is more interesting than the current account since it is the account that takes down economies. Since trade deficits (current accounts) are traditionally balanced with surplus capital accounts, the scales will tip against everyone if the capital account collapses. This is even more difficult to forecast since capital markets are the result of expectations, not realities.

Nonetheless, most agree that this high deficit level is unsustainable. Further, economists agree that it is possible that the current account deficit could be the single greatest threat to the continued prosperity and stability of the United States and world economies.

Lou Jiwei, Chief Investment Officer of China, is perhaps the most influential person in the U.S. economy today. He oversees the $1,250 trillion or so Chinese investment fund, which mostly consists of U.S. treasuries. Because he is investing heavily in the U.S. government (about two-thirds of the fund), we have very low interest rates. This is good for the U.S. as long as the positive economic party continues. But what happens if the music stops?[19]

Many do not believe the Chinese will cause a major disruption to the world financial markets. The author expects very little from them until after the Beijing 2007 Olympic Games. After the Olympics, many anticipate changes more in line with their recent $3 billion investment in the Blackstone Group, which purchases U.S public companies and privatizes them. The Chinese see this as a logical first step considering the xenophobic view from America when the Chinese tried to buy Union Oil Company of California directly.[20]

It is possible that the Chinese will economically squeeze America. However, if China is economically rational, they will force the point over the long run until America becomes of little importance to the world while China ascends.[21] Two centuries ago, Napoleon Bonaparte stated it so well: “When China awakens the whole world will tremble.”[22]

Epilogue

The Durants defined civilization as “social order promoting cultural creation.” Yet history is littered with the ruins of civilizations. These looming economic issues seem to indicate that America is on its deathbed. Most Americans will refuse to believe that this nation must suffer Shelley’s Ozymandias,[23]-that death is the destiny of all. Unfortunately, the disturbing fact is that nations do die. One only has to look back to the early years of the Great Depression to see that we have experienced all of this before.

America is not yet on its deathbed.

In the post-World War II years, America enjoyed a substantial increase in its standard of living. The question is: Will it continue under the new world realities? It will not, in the opinion of the author, unless there is a change in social and economic behavior. America and the world are undergoing fundamental and signal social and economic shifts. The world has not seen, perhaps, such a major shift since the pre-dawn morning of July 16, 1945, in the desert near Alamogordo, New Mexico.[24] In many respects, this new shift and the rise of the age of globalization is even more daunting than the ascendancy of the nuclear age due to globalization’s personal impact on so many individuals.

As Hedrick Smith stated, “In this restless new world, what is needed above all is a new mind set, if America is going to sustain a high standard of living into the 21st century and to prevail as a global economic power in the long-run.”[25] This mind set-to make America work better for more Americans-must change or our retirement portfolios are in jeopardy.

[1] PBS Online. “Candidates Strive to Address Voter Concerns on Economy,” Online News Hour,

[2] Will and Ariel Durant. The Lessons of History, (New York: Simon and Schuster, 1968).

[3] Ibid, 54.

[4] Edmund L. Andrews. “Greenspan Says Federal Budget Deficits Are ‘Unsustainable’,” New York Times, March 3, 2005.

[5] Kyle Almond. “One Man’s Campaign Against Federal Debt,” March 30, 2007,

[6] David J. Walker. “Long-Term Budget Outlooks: Deficits Matter-Saving Our Future Requires Tough Choices Today,” testimony before the U.S. Committee on the Budget, House of Representatives, U.S. Government Accountability Office, Tuesday, January 23, 2007. http://www.gao.gov/new.items/d07389t.pdf.

[7] Established in 1935, Social Security is a U.S. government program to provide benefits to retirees and some other individuals, based on required contributions made during the individual’s working years.

[8] Almond.

[9] A proper estate tax would involve putting a cap on the non-taxed portion of the estate and taxing the remainder at a very high progressive rate with the proceeds going directly to Social Security.

[10] Durant, 55.

[11] There are a number of websites dealing with these economic statistics. See: Michael Hodges. Grandfather Economic Report, (no longer accessible).

[12] Durant, 57.

[13] Barry Bluestone. “Household Incomes and Housing Costs: A New Squeeze for American Families,” testimony before the U.S. House of Representatives Committee on Financial Services, April 4, 2007. http://www.house.gov/apps/list/hearing/financialsvcs_dem/htbluestone040407.pdf. (no longer accessible).

[14] Isabel V. Sawhill, John E. Morton. “Economic Mobility: Is the American Dream Alive and Well?” Economic Monthly, Brookings Institute, May 2007.

[15] It should be noted that, in the real world, savings has three macroeconomic components: (1) personal savings, (2) government savings, and (3) foreign investment (with an open economy coming from foreign savings). It is the foreign investment that is fueling our economic engine and keeping this country afloat.

[16] Maria Bartiromo. Weekend Wall Street Journal Report with Maria Bartiromo, CNBC, The Wall Street Journal, March 27, 2007.

[17] Ben S. Bernanke. “The Global Saving Glut and the U.S. Current Account Deficit,” remarks at the Homer Jones Lecture, St. Louis, Missouri, U.S. Federal Reserve Board, April 14, 2005. http://federalreserve.gov/boarddocs/speeches/2005/20050414/default.htm.

[18] In economics, the capital account is one of two primary components of the balance of payments, the other being the current account. The capital account records all transactions between a domestic and foreign individual that involves a change in the ownership of an asset. It is the net result of public and private international investment flowing in and out of a country.

[19] While China is not the only investor in the United States, they are the most dominant. The world, unlike the United States, has a savings glut.

[20] James Kynge. China Shakes the World, (Massachusetts: Houghton Mifflin, 2006).

[21] One caution about China is that many have noted that the Chinese people do not like the Communist Party and the vast majority wishes for a less corrupt, more equitable regime. An infinitesimal number of people have benefited from economic development. For most Chinese, the feeling of deep-seated injustice is far greater than the hope for a better tomorrow. Hence, the cautionary comment about equilibrium is warranted for China as well; their redistribution could bring poverty yet again, with their importance vastly diminished. Finally, it is quite possible that the Chinese will themselves face economic problems that will bring a major downturn.

[22] Kynge.

[23] A sonnet written by Percy Bysshe Shelley in 1817 with the central theme of mankind’s hubris. Many believe that Shelley condenses the history of not only Ozymandias’ rise, peak, and fall, but also that of an entire civilization. See: Percy Bysshe Shelley, Ozymandias,

[24] The first atomic bomb was tested.

[25] Hedrich Smith. Rethinking America, (New York: Avon Books, 1996): XVII.

Back to top

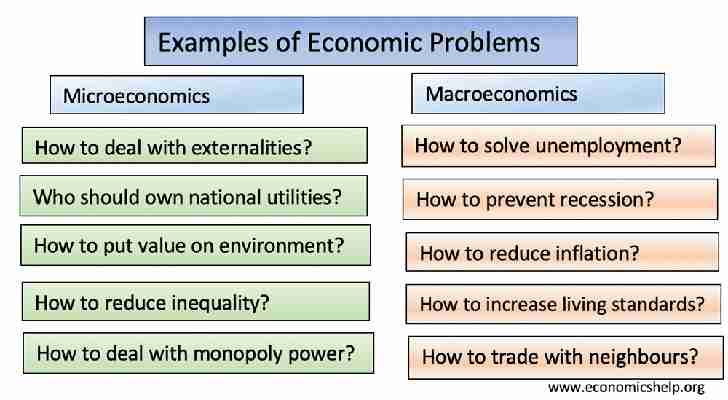

Examples of economic problems

The fundamental economic problem is the issue of scarcity but unlimited wants. Scarcity implies there is only a limited quantity of resources, e.g. finite fossil fuels. Because of scarcity, there is a constant opportunity cost – if you use resources to consume one good, you cannot consume another. Therefore, an underlying feature of economics is concerned with dealing how to allocate resources in society to make the most efficient and fair use of resources. The main issues are:

What to produce?

How to produce?

For whom to produce?

Examples of economic problems include

Video summary

Micro economic problems

1. The problem of externalities

The economic problem of pollution

One of the most frequent problems is that economic decisions can have external effects on other people not involved in the transaction. For example, if you produce power from coal, the pollution affects people all over the world (acid rain, global warming). This is a particular problem because we cannot rely on the free market to provide the most efficient outcome. If we create negative externalities, we don’t take them into account when deciding how much to consume. This is why we can get overconsumption of driving a car into a city centre at peak hour. If everyone maximises their utility, it doesn’t lead to the most efficient outcome – but gridlock and wasted resources.

Externalities, usually need some kind of government intervention. For example, taxes on negative externalities (e.g. sugar tax) or subsidies on positive externalities (e.g. free public education) even banning cars in city centres.

But, even the solution to market failure (e.g. taxes), creates its own potential problems, such as how much to tax? will there be tax evasion? The administration costs of collecting tax.

Environmental issues

Economics is traditionally concerned with utility maximisation – allowing individuals to aim at increasing their economic welfare. However, this can ignore long-term considerations of environmental sustainability. If we have over-consumption in this century, it could cause serious problems for future generations – e.g. global warming, loss of non-renewable resources. The difficulty is that the price mechanism doesn’t take into account these future costs, and policies to reduce consumption may prove politically unpopular.

– How to deal with potential future environmental costs?

Monopoly

Monopoly was an economic problem that Adam Smith was concerned about in his influential book of economics “A Wealth of Nations.” For various reasons firms can gain monopoly power – and therefore the ability to set high prices to consumers. Given a lack of alternatives, monopolies can make high profits at the expense of consumers, causing inequality within society. Monopoly power can also be seen through monopsony employers who pay lower wages to their workers.

How to deal with the problem of monopoly? – A government may seek to encourage competition, e.g. rail franchising, or price regulation to prevent excessive prices.

Inequality/poverty

This shows that 10% of the world population still live on below $1.90 a day – though the figure has reduced in past three decades.

Inequality is considered a problem because of normative opinions such as – it is an unfair distribution of resources. Also, you could argue there is a diminishing marginal utility of wealth. If all wealth is owned by a small percentage of the population, this reduces net welfare. Redistributing the money to the very poor would enable a greater net utility to society.

Five of the world’s largest companies Apple, Microsoft, Alphabet, Cisco and Oracle, have a total of $504bn cash savings (2015) This is money unused, whilst people around the world have insufficient food.

Inequality is a problem. However, it is also a problem to know how much we should seek to reduce poverty. Many will agree on the necessity of reducing absolute poverty – but how far should we take it? Should we aim for perfect equality (Communism) or should we aim for equality of opportunity?

Another issue with reducing poverty is that measures to reduce poverty may cause unintended consequences – e.g. higher income tax on high earners may create disincentives to work. Giving benefits to the low paid may reduce incentives to work.

Volatile prices

Some agricultural markets can have volatile prices. A glut in supply can be bad news because the fall in price can lead to lower revenue for farmers. It could even cause some to go out of business because of a bad year. These volatile markets can cause swings in economic fortunes.

Irrational behaviour

In some asset markets, we have seen volatile prices exacerbated by irrational exuberance. Consumers have often been caught up in a market frenzy – hoping that rising prices will make them richer – and expecting prices to keep rising. We can see this in issues such as tulip mania, the South Sea Bubble, railway mania, and the recent property bubbles.

Macroeconomic problems

Mass unemployment 1933

Unemployment has been a major economic problem in advanced economies. One of the principal causes of unemployment is swings in the business cycle. A fall in demand for goods during a recession, causes people to be laid off. Because of the depressed state of the economy, there is an imbalance between demand and supply of workers.

Unemployment can also be caused by rapid changes in labour markets, for examples, unskilled workers unable to gain employment in a high tech economy. Unemployment is a problem because it is a waste of resources, but more importantly, it leads to very high personal costs, such as stress, alienation, low income and feelings of failure.

Recession

A recession is a period of negative economic growth – a decline in the size of the economy. It exacerbates problems of inequality and unemployment. A problem of recession is that it can create a negative spiral. When demand falls, firms lay off workers. The unemployed have less money to spend causing further falls in demand.

In the great depression, unemployment rose to over 20% – the unemployed also had little support and relied on soup kitchens.

Inflation

High inflation can be a serious problem if prices rise faster than wages and nominal interest rates. In periods of rapidly rising prices, people with savings will see a decline in their real wealth. If prices rise faster than wages, then people’s spending power will decline. Also, rapidly rising prices creates confusion and uncertainty and can cause firms to cut back on investment and spending.

Countries which have experienced hyperinflation, have seen it as a very traumatic period because all the economic certainty is washed away, leaving people without any certainty. Hyper inflation can cause not just economic turmoil but political turmoil as people lose confidence in the economic situation of the economy.

Balance of payments/current account deficit

A current account deficit on the balance of payments means an economy is importing more goods and services than it is exporting. To finance this current account deficit, they need a surplus on the financial/capital account. For many modern economies, a small current account deficit is not a problem. However, some developing economies have experienced a balance of payments crisis – where the large deficit has to be financed by borrowing, and this situation usually leads to a rapid devaluation of the currency. But, this devaluation increases the price of imports, reduces living standards and causes inflation.

Exchange rate volatility

In some cases, the exchange rate can cause economic problems. For example, countries in the Euro were not able to change the value of their currency against other Eurozone members. Because countries like Greece and Portugal had higher inflation rates, they became uncompetitive. Exports fell, and they developed a large current account deficit. The overvalued exchange rate caused a fall in economic growth.

On the other hand, a rapid devaluation can cause different problems. For example, when the price of oil fell, oil exporting countries saw a decline in export revenues, leading to a fall in the value of the currency. A rapid devaluation causes the price of imports to rise and causes both higher inflation and lower growth. A difficult problem for policymakers to deal with.

Development economics

Developing economies face similar economic problems, but any issue is magnified by low GDP and high levels of poverty. For example, unemployment in a developing economy is more serious because there is unlikely to be any government insurance to give a minimum standard of living.

Poverty cycle. Some developing economies may be stuck in a poverty trap. Low growth and low saving ratios lead to low levels of investment and therefore low economic growth. This low growth and poverty cause the low savings and investment to be continued.

More examples

Last updated: 17th November 2019, Tejvan Pettinger, Oxford, UK